Being debt free in today’s world is similar to finding a unicorn. There are just too many payment plan options out there that look so appealing that staying in debt is way easier than trying to figure out how to do life without debt. But after a few years of trying to keep up with the payments and watching money go out the door for things we could have just saved up and bought my husband and I decided we were done with payments and thus started the longest most difficult yet rewarding journey of my life, aside from motherhood. Along the way, we learned a lot of lessons, many of which we learned the hard way. If you are in a place where you would like to just get a glimpse at what it takes to start the process, keep reading!

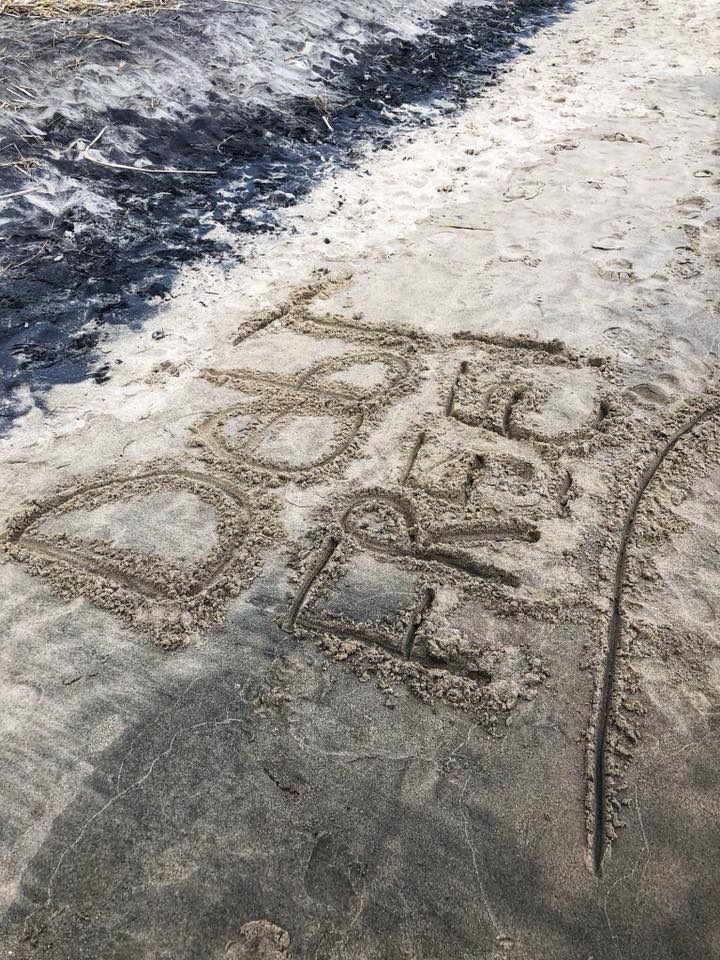

DO have some money in savings before starting.

It is fact that once you start paying debt off and quit using credit cards as a plan for emergencies lots of things will start to fall apart. Your car will stop working correctly, the washing machine will start making a weird clicking sound and a kid will probably get sick. Going into a debt free journey without a savings account is a bad plan. So, make sure you have at least $1,000 in savings at all times. If you use some for an emergency make sure to pay it back right away.

DON’T look at the whole debt monster at once.

Maybe you don’t have a lot of debt and this will only take you about 6 months to accomplish. Good for you! For the rest of us, we get all of our bills in order and any outstanding debts and by the time we have added it all up, we can’t even see straight. Quitting sounds really good right about now. Once you get your bills in order of smallest to greatest payments, not interest, and you pull your credit report to make sure you even know what is on it, like…maybe an old library book? Ahem. Then you can start paying them off one by one smallest balance to largest.

DO make a plan

Going into something as life-changing as this especially if you are used to living paycheck to paycheck or using a credit card to make up the difference in income you must have a plan in place or the old ways of doing things are going to rear their ugly head. If you are married, this plan MUST be made together with your spouse. If one of you makes a plan and commits to it, and the other one goes and does whatever they want, this will not work.

DON’T make such a tight budget you hate your life

In my marriage, I am considered more of the “nerd.” I love making plans and paying the bills and watching our savings grow and our debt decrease. But I would also starve us to death if my husband who is more of the “free spirit” didn’t say “honey, we have to eat still.” So, in order to find a happy medium, we plan our fun. We set money aside each paycheck for pocket money for the both of us, and entertainment money. That way we are still following a budget and we are still having some fun.

DO share your story

Starting this process, especially for me, was embarrassing in a way because I thought living debt free and paying off bills would look like we were irresponsible and immature or out of control. That can be the case and I guess for the most part is was the case for us, but after getting past those feelings and really learning how unwise using debt actually is and costs so much later on in interest and overall cost it feels good to know that is not the way you are choosing to spend money anymore. I started sharing our journey with friends and family in a non-pushy way and we had lots of people come to ask for advice or tips and we got to share that there is a different way to handle money instead of the way Mastercard would love to tell you.

DON’T listen to the naysayers

Sharing our journey, our progress and our downfalls was helpful to a lot of people but it also welcomed unsolicited advice from others who wanted to make sure we knew there was “no way to be completely debt free.” I learned that arguing was pointless. I began to just politely nod and tell them I understood why they felt that way, but we have chosen to live differently. I never try to convince anyone, and we are still friends with lots of people who are still paying car payments, credit card statements, and furniture payments. Heck, I found out you can have payments on a vacuum! Who would’ve thought?!

Getting life under control after letting it get so far out of control is daunting. Make a plan, stick to it and learn how to say no. It is hard and sometimes not fun, but I learned there are lots of things I could wait another week on and buy in cash instead of on a credit card and the purchase is so much sweeter then.

What are other tips you have to living debt free?